An Minh’s duties when providing tax and accounting services

After estimating the number of documents incurred monthly, An Minh would like to advise suitable service packages to save maximum costs for businesses.

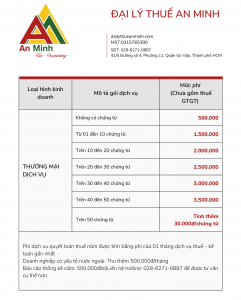

>> Refer to the service fee price list below

inward invoice sale receipt

So what do customers need to provide when using tax – accounting services

An Minh tax agent is having preferential promotion for the first quarter of service fees when customers register for tax agency and tax consulting services at the company. (Applicable to new customers and registered for tax services by year) |

AN MINH TAX AGENCY – SAFETY AND TRANSPARENCY